The Ultimate Guide to WooCommerce Payment Gateways

The Ultimate Guide to WooCommerce Payment Gateways

WooCommerce payment gateways are integral components of every WooCommerce site. They determine which payment methods your customers have access to as well as how you ultimately receive payments from customers.

In this post, we’re going to discuss what WooCommerce payment gateways are and how they work. We’ll also cover the best payment gateways available for WooCommerce as well as how to choose the best ones for your site.

Let’s get into it.

What are WooCommerce Payment Gateways?

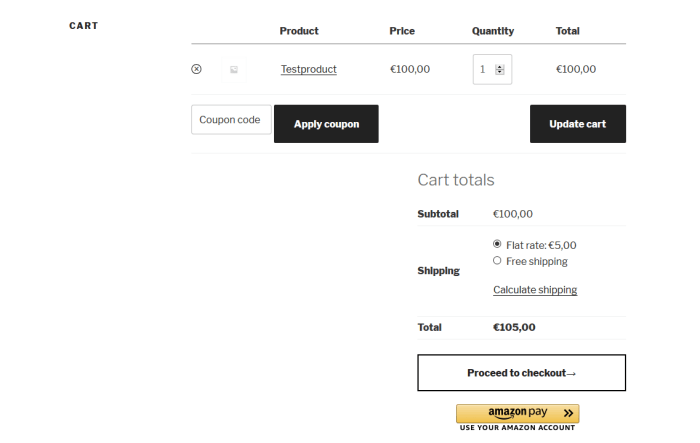

When you get to the checkout page of an online store, you’ll typically see a few different options at your disposal. Among the many are PayPal and credit card payments. Some businesses even allow you to pay via direct bank transfer.

As you likely know, every single element or style you see on the web is powered by code. When it comes to ecommerce and online payments, that code makes up processes known as “payment gateways.”

PayPal is a type of payment gateway because it offers you a way to process payments on your site. This is why standard credit card payments aren’t gateways on their own. Instead, they’re powered by payment gateways like PayPal, Stripe and Square.

That being said, WooCommerce payment gateways are simply gateways available for the WooCommerce ecommerce platform.

How Does a Payment Gateway Integration Work?

Some payment gateways are available in WooCommerce by default. In this case, their processes have been built into the WooCommerce application itself. The majority of payment gateways will need to be installed as plugins.

It’s not uncommon to find a WooCommerce payment gateway plugin for free in the WordPress plugin directory. WooCommerce even offers a few free payment gateway extensions of their own. Some, however, will need to be purchased as premium products.

It’s important to note that implementing a payment gateway on your site isn’t as simple as installing a plugin that offers the integration. You’ll need to set up an account on the gateway’s site to complete the integration so they can process payments for you.

This involves getting your tax information right and ensuring the payment gateway supports your country or currency. Some payment gateways even require you to have a merchant account, which is different PayPal, your bank account or your account with your payment gateway.

What is a WooCommerce Custom Payment Gateway Configuration?

It may wind up being a rare occurrence for your store, but some customers may get to the checkout page only to discover you don’t offer a payment method compatible with their location or currency. You can implement a custom payment gateway configuration as a workaround for this.

This type of configuration allows the customer to submit an order with a note describing how they’d like to pay. You can work with the customer to complete their order if you accept.

A couple plugins that allow you to implement this configuration include WooCommerce Custom Payment Gateway and Custom Payment Gateways for WooCommerce.

You can also receive support from our team here at StorePro if you run into this issue and want to hand the task of finding a solution over to us.

5 Best WooCommerce Payment Gateways

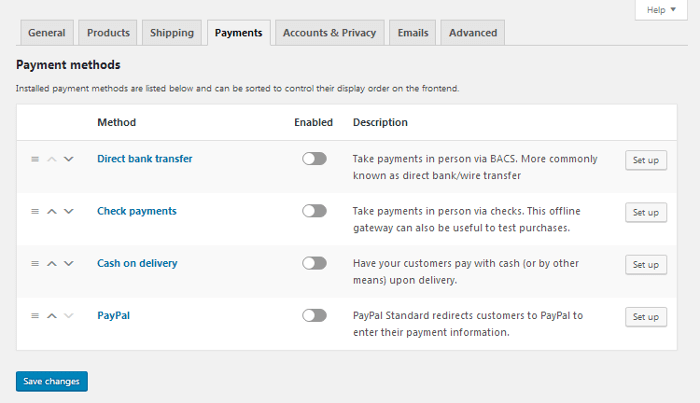

WooCommerce offers a few payment gateways by default, which are:

- Direct Bank Transfer – Accept payments directly from customers’ bank accounts or via wire transfers.

- Check Payments – For in-person payments.

- Cash on Delivery – For in-person payments that are only paid when the customer receives what they ordered.

- PayPal – Enables PayPal Standard for your store.

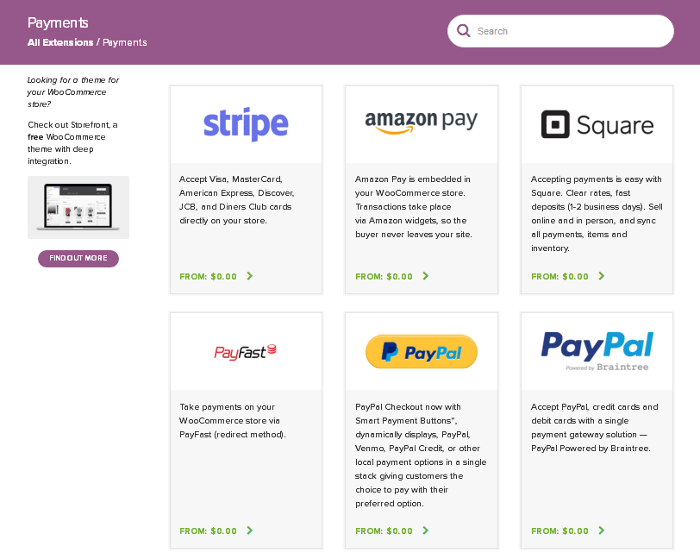

Additionally, before we jump into our list, it should be noted these aren’t the only payment gateways available for WooCommerce. There are many more plugins available for additional payment gateways in the official WooCommerce extension store.

You may also find more through third-party developers. Be sure to dig a bit deeper into these gateways if the ones listed below don’t offer what you’re looking for.

With that said, let’s jump in with number one.

1. PayPal

PayPal was founded when Confinity, a developer of security software for handheld devices, merged with Elon Musk’s online banking company X.Com in the year 2000.

It’s grown to become one of the web’s largest payment processors ever since. It earned over $15.45 billion in revenue in 2018 alone and has over 275 million active users worldwide.

It also happens to be a staple payment processor for online stores around the web, including WooCommerce stores.

Pros

- Accept payments directly through PayPal or via credit and debit cards.

- Supports over 200 countries and regions as well as 25 currencies around the world.

- Give your customers financing options.

- PayPal’s instant transfer service, which charges a 1% fee or $10 (whichever is greater), allows you to transfer funds to your bank account instantly.

- Large user base.

- Plenty of options to choose from.

- Free options available.

Cons

- Fees can get expensive, especially if you’re outside of the US.

- Support is notoriously hit or miss.

- PayPal has been known to freeze users’ funds for up to six months for cases not related to fraud or illegal activities.

Integration Options

- Default PayPal Standard (Free)

- Accept PayPal, PayPal Credit, credit cards and debit cards.

- Pay 2.9% + $0.30 on every online transaction in the US and 4.4% + a fixed fee based on your currency on every online transaction outside of the US.

- Accept recurring payments through an integration with the WooCommerce Subscriptions extension.

- PayPal Checkout (Free)

- Accept everything from PayPal Standard plus Venmo in the US and local payment options in some countries.

- Fees the same as PayPal Standard.

- Can be set up to handle payments on your site as opposed to redirecting you to PayPal as PayPal Standard does.

- Can be integrated with WooCommerce Subscriptions.

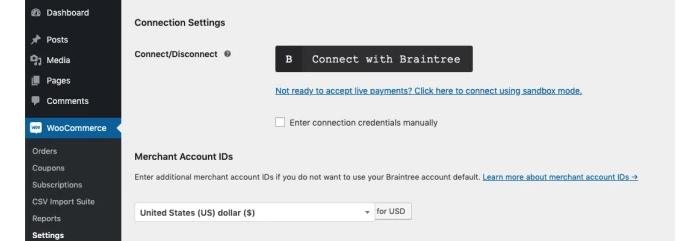

- PayPal Powered by Braintree (Free)*

- Accept everything from PayPal Standard.

- Fees the same as PayPal Standard.

- Only available in US, Canada, Europe, Australia, New Zealand, Singapore, Hong Kong and Malaysia.

- Payments are handled on your site.

- Integration with WooCommerce Subscriptions available.

- Your choice in fraud protection.

- Process refunds from WooCommerce.

- PayPal Pro ($79)**

- Accept everything from PayPal Standard.

- Fees the same as PayPal Standard, but you’ll also be required to pay a $30 monthly fee.

- Allows you to customize the checkout page to hide any mention of PayPal. Payments are handled on your site because of this.

- Accept payments in person, by phone or via fax with the Virtual Terminal feature. No card swipe necessary.

- Only available in US, UK, Canada and Australia.

*Braintree integration with WooCommerce is also available via a free plugin called Braintree for WooCommerce. Along with PayPal, this plugin also allows you to use Braintree’s integration with Google Pay and Apple Pay.

**This integration can also be achieved with a free plugin called WooCommerce PayPal Pro Payment Gateway.

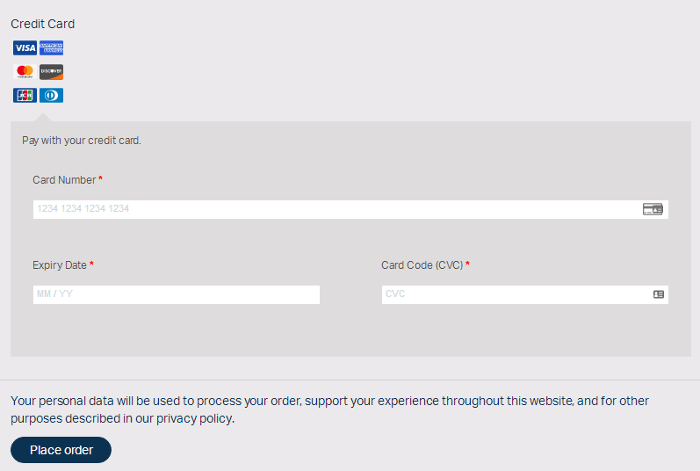

2. Stripe

Founded in 2010, Stripe has quickly become the go-to solution for processing credit card payments despite being much younger than PayPal. In fact, it became a $20 billion company in 2018.

Its popularity has carried over to the WooCommerce community, and with fewer integration options to choose from, implementing this solution can actually be a bit easier.

Pros

- Accept credit and debit card payments.

- Allows you to accept wallet payments from eight providers, including Google Pay and Apple Pay.

- Accept local payment methods, including ACH Debit, AliPay and WeChat Pay.

- Available in over 25 countries and accepts over 135 currencies.

- Comes with support for mobile payments (Terminal feature) in person.

- Built-in fraud protection.

- Quick payouts. Scheduled payouts also available.

Cons

- A flat fee of 2.9% + $0.30 is charged on every transaction, but additional features will add to your total cost. For example, accepting international cards costs an additional 1% per transaction, and the Terminal feature costs $59 per device. Fortunately, in-person transactions have lower fees of 2.7% + $0.05 per transaction.

- Like PayPal, Stripe has been known to freeze users’ funds.

Integration Options

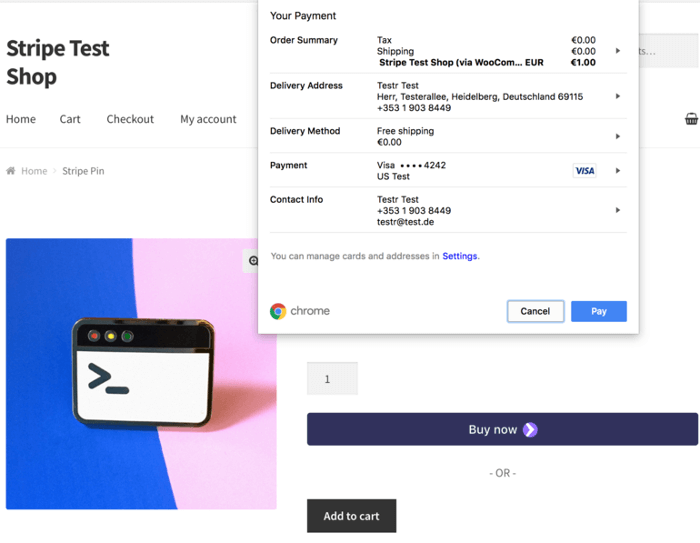

- Stripe from WooCommerce (Free)

- Payments are handled on your site.

- Process refunds from WooCommerce.

- Supports WooCommerce Subscriptions.

- Request payment on product pages for faster checkout experiences.

- WooCommerce Stripe Payment Gateway (Free)

- Payments are handled on your site.

- Distribute full or partial refunds.

- Restrict payments to preferred cards only.

- More features available in a premium version for $59.

- YITH WooCommerce Stripe (Free)

- Redirect customers to a Striped-hosted checkout page or showcase checkout as a pop-up on checkout page.

- Deploy tests with dummy credit cards.

- More features available in a premium version for $79.99.

3. Square

Square is mostly known for its point-of-sale (POS) technology, which allows small and large businesses alike to collect credit and debit card payments in person. It get its name from the small, square-shaped card readers merchants can use with their phones to collect card payments.

The company was founded in 2009 by Twitter co-founder and CEO Jack Dorsey and his friend Jim McKelvey after the latter was unable to complete a $2,000 sale as a result of not having a simple way to accept credit cards on the fly.

Square has grown steadily ever since. It earned $3.29 billion in 2018 alone, and although its mostly known for POS, it’s also a payment gateway for online payments.

Pros

- Accept credit and debit cards.

- Accept these forms of payments in person with various POS devices.

- Transaction fee lowered to 2.75% for in-person payments.

- Input manual payments for customers who want to pay over the phone. This is Square’s “Virtual Terminal” feature.

- A freemium ecommerce platform developed by Square that integrates with WooCommerce allows you to pay lower transaction fees of 2.6% + $0.30.

- No statement or chargeback fees.

- Fraud protection included.

- Quick payouts, including same-day and instant deposits.

Cons

- You’ll pay a 2.9% + $0.30 transaction fee per online payment, but manual payments taken over the phone cost 3.5% + $0.15 per transaction.

- Instant deposits to your bank account are limited to $500 per day while you’re a new seller. Plus, higher daily deposits are not guaranteed even if you grow your business.

- Customers are not able to save their card details for future payments with WooCommerce’s official Square integration.

- Only available in select countries.

Integration Options

- Square for WooCommerce (Free)

- Payments handled on your site.

- Syncs products to Square.

- Only available in US, UK, Canada, Australia and Japan.

- WooSquare Pro ($69)

- Payments handled on your site.

- Syncs products to Square.

- Manage refunds between WooCommerce and Square.

- Only available in same countries as Square for WooCommerce.

4. Authorize.net

Founded in 1996 when the web was just getting its wings among average consumers, Authorize.net is one of the oldest payment gateways in existence. Today, it supports more than 430,000 merchants and processes over 1 billion transactions and $149 billion in payments every year.

Authorize.net’s popularity and influence in the industry has naturally carried over to WooCommerce. It has one of the best ratings of any payment gateway extension in WooCommerce’s official store.

Pros

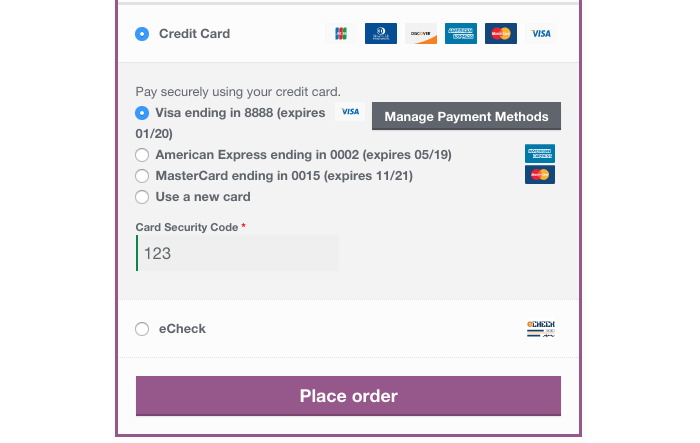

- Accept credit cards, debit cards and eChecks.

- Receive payments in person with Authorize’s mobile features and card readers.

- Accepts currencies from all around the world.

- Fraud protection included.

- You’ll need a merchant account, but if you have one when you sign up, you’ll only pay $0.10 per transaction. PayPal is not accepted as a merchant account.

Cons

- Only works in the US, UK, Canada, Europe and Australia.

- Charges a fee of $25/month, plus you’ll still need to pay the standard transaction fee of 2.9% + $0.30 if you don’t have a merchant account when you sign up.

- Payouts take 3-5 business days.

- Official WooCommerce integration costs $79.

- Authorize.net’s other payment options, such as Apple Pay, are not supported by WooCommerce.

Integration Options

- Authorize.net for WooCommerce ($79)

- Payments handled on your site.

- Process refunds from WooCommerce.

- Supports WooCommerce Subscriptions and WooCommerce Pre-Orders.

- Authorize.net Payment Gateway for WooCommerce (Free, by Pledged Plugins)

- Simple way to integrate Authorize.net on your site for card payments.

- Process refunds from WooCommerce.

- Only accept payments from specific card types.

- A premium version offers support for WooCommerce Subscriptions, WooCommerce Pre-Orders and payments from saved cards.

- Doesn’t accept eChecks.

- Authorize.net Payment Gateway for WooCommerce (Free, by Ishan Verma)

- Simple way to integrate Authorize.net on your site to accept credit and debit cards.

- Doesn’t accept eChecks.

- Payments are handled on Authorize.net’s servers.

5. Amazon Pay

Amazon Pay is a payment processing solution developed by Amazon in 2007. It allows shoppers to pay for orders from thousands of stores across the web using the payment methods saved in their Amazon accounts.

While Amazon Pay’s growth hasn’t been as significant as some of the other options on this list, it’s still become a popular payment gateway among WooCommerce store owners.

Pros

- Accept credit and debit card payments.

- Similar to PayPal, Amazon Pay can increase conversions by making the checkout experience quicker for customers.

- Built-in fraud protection.

Cons

- Payouts take 3-5 business days.

- Most businesses will pay the standard transaction fee of 2.9% + $0.30, but some services cost more. This includes payments made through Alexa, which cost 4% + $0.30 per transaction, as well as payments that come from an international payment method, which cost 3.9% + $0.30 per transaction.

- Only available in a limited number of countries.

Integration Options

- Amazon Pay for WooCommerce (Free)

- Payments are handled on your site.

- Built-in recovery mechanisms ensure failed transactions aren’t lost.

- Supports WooCommerce Subscriptions.

- Amazon Pay WooCommerce Payment Gateway (Free)

- Payments are handled on your site.

- Thank You page included.

- ELEX Amazon Payments Gateway for WooCommerce ($59)

- Payments handled on your site.

- Supports recurring payments.

- Allow customers to bypass the shopping cart by buying with a single click.

- Refunds handled in WooCommerce. Partial refunds are also supported.

Things to Consider in WooCommerce Payment Gateways

Because of the open-source natures of WordPress and WooCommerce, you have two issues to worry about in regards to choosing a WooCommerce payment gateway.

The first is which payment gateways you’d like to use on your site. The second is how you’d like to integrate those gateways as each one has multiple integration options.

Consider the following factors while you make your decision.

What Do Your Competitors Use?

Start by browsing your competitors’ sites and going through their checkout processes to see which payment methods they accept. Because you share a customer base, you may just find a gold mine of payment gateways your customers expect to find on your store.

Where are You Located?

I listed which countries or general regions each payment gateway operates in. Many work in countries like the United States or regions like the United Kingdom, but if you operate elsewhere, you may need to dig deeper to see if the payment gateways listed above support your country or region. You may even need to find alternative gateways.

Furthermore, payment gateways aren’t popular universally. Customers in certain countries or regions may favor one or the other. Make sure you choose a payment gateway your country prefers.

Do You Want Direct or Redirect Payment Processing?

Consumers are becoming more and more impatient as the web’s influence over multiple industries grows. Ecommerce is no different, and if the shopping experience on your site is difficult or laborious in any way, you may lose conversions.

This is why it’s best to choose payment gateways and plugins that offer direct payment processing where payments are handled on your site rather than having the customer be redirected to the payment gateway’s site.

You’ll have to beef up security and instill your customer’s confidence in you, but it’ll make the checkout experience much quicker, which in turn will make your conversion rate grow higher.

What is Your Budget?

Most payment gateways charge the standard 2.9% + $0.30 per transaction, though some may charge extra for certain services. Plus, some of the plugins that integrate these payment gateways into your site cost an additional fee. Be sure the payment gateway(s) and plugin(s) you choose aligns with your budget.

StorePro is Here to Help

Finally, if you’re having trouble choosing and implementing payment gateways for your store, allow us to step in. We offer worry-free WooCommerce support for store admins.

For just $1, you can give our services a try with a single task. Get in touch to get started.

Shares

Shares